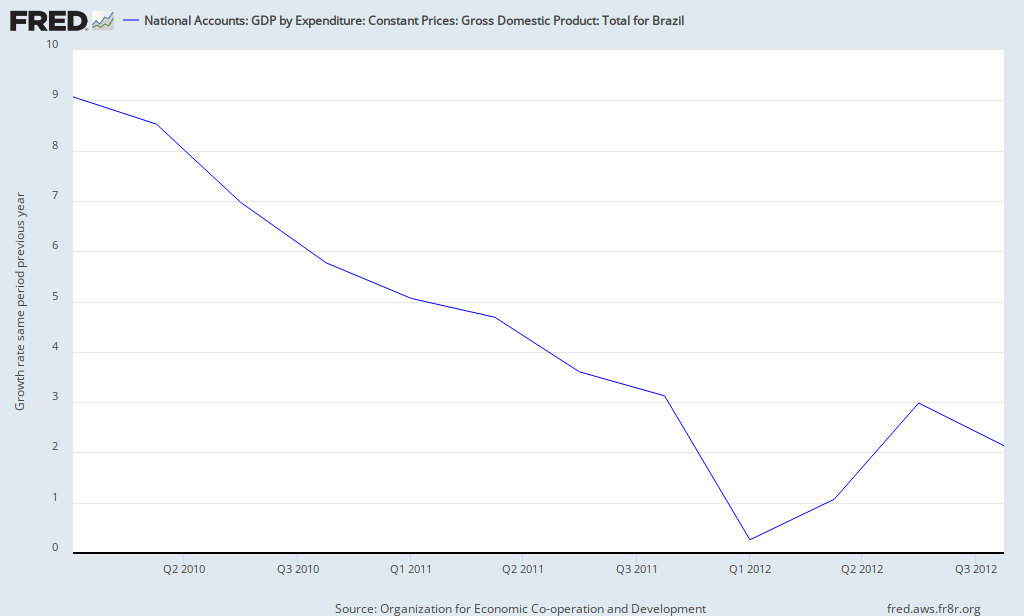

Recent data has confirmed the trend of the past 2 years: Brazil is slowing down.

Counter-intuitively, this might be good news for innovation-driven Venture Capital in the region.

---

Between 2006 and 2010, Brazil grew at a CAGR of 4.6% ; but it has only grown at a 1.8% rate since. Moreover, forecasts have been revised down by the Brazilian Central Bank for 2013 and 2014.

There are many reasons behind this slower growth, but the halt on the bull market for commodity prices is probably the main one. Arguably, the other one is that Brazil has only been investing 20% of GDP (vs 45% in China), resulting in bottle-necks in two key sectors: Infrastructure and Human Resources.

Our main interest is in the latter since labor, more specifically highly-qualified labor, is the main input of the Venture Capital industry.With salaries in San Pablo being second only to New York City and London, Brazil became a very expensive place to produce for-export products, specially if they needed a lot of skilled labor. Furthermore, a lot of talent was driven to real estate and banking where the most money could be made.

However, the recent slower growth has had a significant effect on the BRL/ USD exchange rate that went from 1.6 in 2011 to 2 today, making Brazilian salaries much cheaper from a Foreign Direct Investment perspective.

At the same time, it can be argued that this diminished growth will provide the incentives for the government to invest in infrastructure, innovation and education that will be the pillars of future high growth in 5-15 years time.

---

There is good evidence that Venture Capital is a cyclical business with a Beta ranging from 1.1 to 2.4 depending on the chosen methodology. Financially, the causality is pretty straight forward as valuations are driven by comparables and lower stock prices ultimately drive start ups' exit multiples and returns down. Economically, lower GDP growth leads to lower projected sales (and harder market entry) that drive valuation.

Consequently, getting the cycle right is very important to achieve top percentile VC returns.

The first important clarification is that VC investments last 8-12 years, so getting the cycle right means being at the top of the cycle in the next 6-10 years. It does not require high growth at the moment of the Vintage. Quite on the contrary, hard times provide with low entry multiples and can provide high returns.

The second caveat is that this relationship is mostly based on US Venture Capital Funds where the company's origin is usually also its main target market.

---

The Brazilian Venture Capital Industry is mostly focused on copy-cats. This means that they invest in Brazilian versions of successful US ventures. The objective of these companies is to capture the local market with foreign innovations copied and produced by local companies. The success of this model depends heavily on the size of the market so this recent change in macroeconomic trends is worrisome.

This is were the first caveat we mentioned before comes in. Slow growth means cheaper valuations today, allowing for good returns by riding the potential future growth in multiples tomorrow. So, this might just be the perfect time to invest in Brazil.

This is were the first caveat we mentioned before comes in. Slow growth means cheaper valuations today, allowing for good returns by riding the potential future growth in multiples tomorrow. So, this might just be the perfect time to invest in Brazil.

We are even more bullish about Brazilian Funds that invest in companies that produce innovative technology for the world. These companies take Reais-priced labour as an input to produce products valued in USD. So, the exchange rate jump caused by the slowdown has already made these investments around 25% cheaper. Also, the slowdown of Brazil has little effect on their target market, the global market.

At the same time Brazilian investment in R&D continues to grow at a back breaking speed. Consequently, the deal flow of of companies with VC-style technologies is set to grow steadily over time.

Furthermore, as we said before, there are good reasons to believe recent economic developments will refocus government efforts towards investments much needed for the future success of technology companies.

---

To sum up, the slow down in Brazil can actually be good news for its Venture Capital Industry as Funds ride the future growth in multiples while investing cheaply in lower salaries in a fast-growing industry

No comments:

Post a Comment